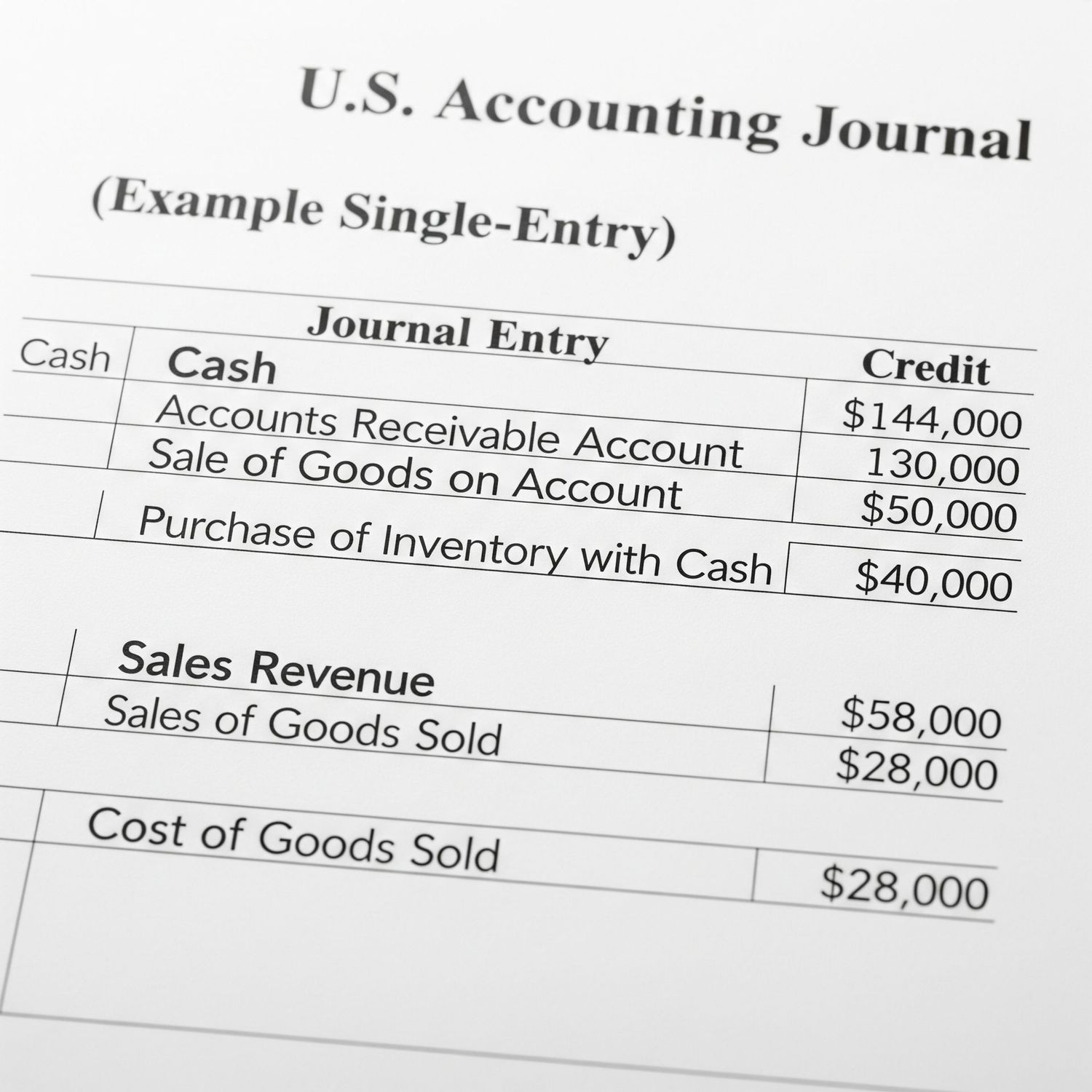

Journal Entries (per entry)

| Quantity | Price per item | Discount |

| 25 items | $15.00 | 25% off |

Month-End Adjustments & Closing

Accruals & Deferrals:

Make necessary adjusting journal entries for:

Accrued Expenses:

Expenses incurred but not yet paid or billed (e.g., estimated utilities).

Accrued Revenue:

Revenue earned but not yet invoiced.

Deferred Revenue:

Payments received for services/goods not yet delivered.

Prepaid Expenses:

Expenses paid in advance (e.g., insurance premiums) that need to be expensed monthly.

Depreciation & Amortization (if applicable):

Record monthly depreciation for fixed assets and amortization for intangible assets.

Inventory Adjustment (if applicable):

If you track inventory, reconcile physical inventory counts with book inventory, and make necessary adjustments for shrinkage, spoilage, etc.

Close the Books for the Month:In your accounting software, "close" the month to prevent accidental changes to prior period data